The Australian financial scene has gone through extensive structural reform over the last forty to fifty years. For many decades, the Australian financial sector was heavily regulated, which undermined investor confidence, meaning the Australian economy received minimal foreign direct investment. Here are some of the most significant changes that have occurred in Australian financial markets.

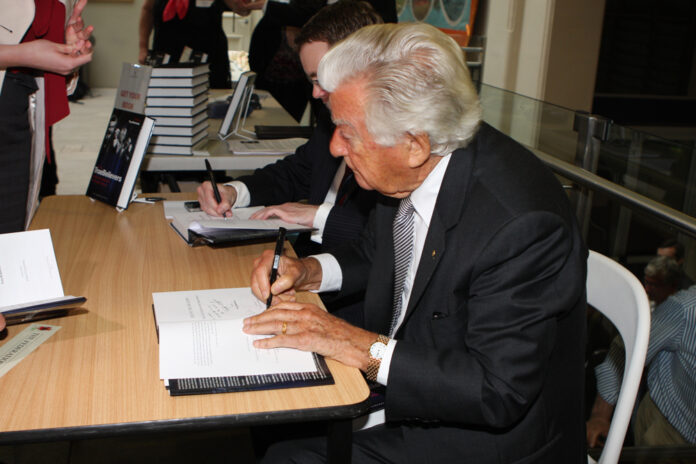

Deregulating the Australian Dollar

The Australian Dollar was first introduced in February 1966, where it replaced the pre-decimal Australian pound. Before 1983, the Australian Dollar was maintained via a fixed exchange rate system. Initially, it was pegged against the British pound before pegging the currency against the United States dollar during the 1970s. On December 1983, the Hawke Government floated the Australian Dollar for the first time, under the guidance of Treasurer, Paul Keating.

The Royal Commission

The recent Royal Commission has significantly changed the public’s perception of the big four banks: the Commonwealth Bank of Australia (CBA), the National Australia Bank (NAB), Westpac Banking Corporation and Australia and New Zealand Banking Group (ANZ). With evidence of widespread corruption, misconduct and negligence, the Royal Commission has irrevocably changed how customers and households engage with their local banks.

Growth of the services sector

Investors will understand the Australian manufacturing scene has declined significantly over the past few decades. Since the early 1970s, manufacturing has fallen 25% of employment positions to under 10%. Where have they all gone? Well, Australia has structurally shifted to more service-based industries, which now equate for more than 80% of all employment in the Australian economy.

As a result, many investors tend to focus on service industries when investing, which represents a dramatic shift from earlier investor strategies. Rapidly growing tech companies are quickly superseding manufacturing businesses as the most desirable shares for investors.